Contact us

800 HSBC TRADE(800 4722 87233)

Now more than ever, businesses need a strategy that will maximise the efficiency and effectiveness of their working capital processes.

In these challenging times, managing cash and payment flows, and maximising available working capital, is more critical than ever. Businesses – whatever their size, scale or reach – need the right tools to help them maintain visibility and control of their working capital, as well as increase efficiency.

Effective working capital management starts with having the visibility to manage your cash. This in turn allows you to make and receive payments, improve receivables, manage debtors, and ultimately invest efficiently using banking tools provided by committed partners such as HSBC.

Cash management is critical for success

Now more than ever, businesses need a strategy that will maximise the efficiency and effectiveness of their working capital processes. This will lead to improved liquidity – key in a challenging economic environment – and operational efficiencies which allow companies to assess and respond to situations more quickly.

In a recent poll, HSBC asked clients what their key areas of focus were in working capital management. Over half (51 percent) wanted more efficiency through improving metrics such as DSO and DPO, while nearly the same number (49 percent) cited optimisation of liquidity structures. Having the capability to move liquidity around your organisation to allow it to benefit different lines of business when they need it most can be extremely valuable – HSBC provides this optimal balance of liquidity through meaningful structures and payments/receivables.

Yet the key is to maintain the right balance of working capital to allow your business to thrive whilst not having wastage or inefficiency. HSBC’s expansive network and global experience can help you achieve that balance, with both established and new-to-market products and services that support liquidity management, accounts payable and accounts receivables.

Real-time visibility is vital

Organisations with various locations, branches and outlets simply cannot manage cash in a vacuum. Visibility is essential in every part of the treasury and finance functions. Being able to understand real-time positions across entities and geographies is key to being able to spot and then quickly utilize funding within the organisation.

Nearly two-thirds (64 percent) of clients in a recent poll said that delayed payments will be one of their biggest challenges in the next three to six months in terms of working capital. Nearly half (46 percent) also cited customer defaults.

HSBC’s Cash Concentration tools allow clients to quickly move their funding to where they need it most, while tools like the Liquidity Management Portal – which can be reached through the HSBCnet platform – allow granular visibility. Clients can make informed decisions and mitigate risks with the easy access that the platform provides to balance composite and distribution, along with market information and data.

Avoid delays with “right-time” payments

Real-time and immediate payment schemes give clients the option of choosing when to make payments. They allow companies to move parts of their business to a “right-time” approach, so that working capital is not tied up in an inefficient clearing house cycle. This approach also eliminates concerns about missing cut-off times, allowing businesses to flex their working capital in the best way. Simultaneously, for certain unique payment types such as salary payments, there can be a different mode of payment that can be offered by your banking partner, that takes into account any regulatory obligation (e.g. Wage Protection System) as well as confidentiality of data.

HSBC also recognises that payments flow both ways – clients need inward payments to move as seamlessly as possible before making outward transactions. Here, too, visibility is crucial, as delays can tie up working capital. Our clients can offer multiple “inward payments” options to payors, while simultaneously enjoying very strong visibility, reporting and reconciliation abilities.

Maximise working capital

Understanding your receivables allows you to put incoming funds to work in a way that will quickly help your business. A simplified, efficient digital receivables strategy goes a long way to maximising working capital. That’s why getting the right solution for your organisation is essential.

HSBC’s Virtual Accounts has allowed clients to streamline reconciliation of receivables, simplify receipts and achieve 100 percent identification of payer without exceptions regardless of the quality of information attached to the incoming payment. In the UAE, we have a next-generation Virtual Accounts solution that allows clients to manage multiple legal entities in one structure applying inbound receipts efficiently and also allowing virtual account participants to make outward payments from their virtual accounts. This solution provides for robust reporting and reconciliation abilities including providing account statements in standard formats (e.g. MT940s, camt formats) for each of the virtual accounts.

In a fast-changing world, companies need to know how best to use available funding and practise efficient working capital management. HSBC is an industry leader in this area, with a vast range of tools – both digital solutions and best practice principles – to help support your business through this difficult time.

Polling infographic

During our webinar we polled over 150 businesses on their approach to working capital in the current environment – here are the results.

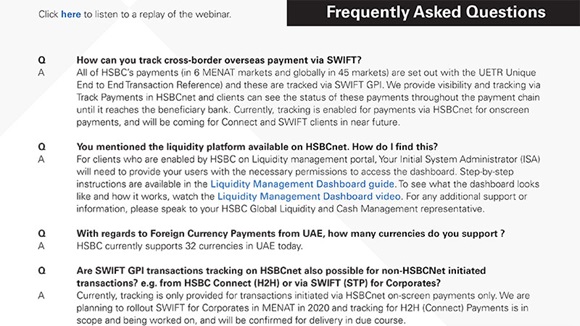

Frequently Asked Questions

See the most commonly asked questions, and their answers, on the attached FAQ